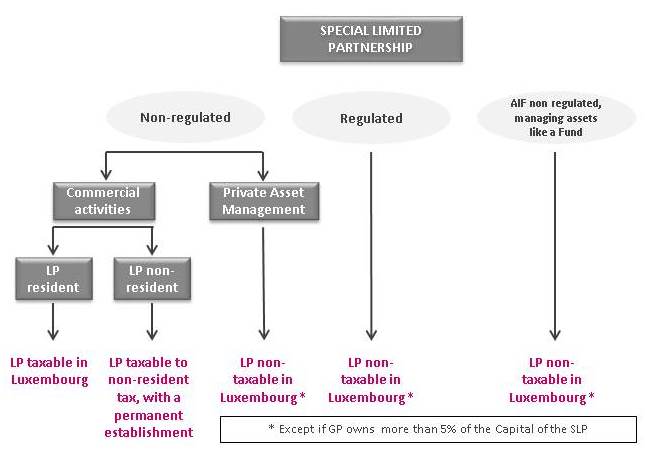

Luxembourg Tax Law (LTL) makes a distinct differentiation between commercial activities and activities which are considered "only" as lucrative activities.

Commercial activities are linked to commercial, agricultural or industrial activities which are generally subject to an authorisation of establishment (regulated business licence). They are carried out on a permanent basis with the intention of earning profits and participating in the economic life.

Lucrative activities stay outside the commercial activity scope. They are mainly civil activities carried on with the aim of securing investment and to realise a (potential) profit. However, they are not considered to be a commercial activity, even though they are performed by the Partnership to create profit for the partners.

For example, an investment in real estate property made by different partners, which is intended to be sold after construction or rented out, is a civil activity not subject to a business licence. It is therefore considered to be a Lucrative Activity.

The same applies for private equity deals, co-investments, investments in intellectual property, renting movable or immovable assets, managing a portfolio of securities, etc.

When private assets (movable or immovable) are managed by a Partnership of private individuals, the partners are not liable for tax on the activities realised within the Partnership (if it stays a private asset management e.g. holding a real estate, plan, boat, art, cars, etc).

Alternative Management of assets: tax authorities consider that these undertakings are deemed not carrying any commercial activities but an investment management activities (like hedge fund, private equity, PERE, or any other alternative investments).

Commercial Activities realised in Luxembourg

The partner profits derived from Commercial Activities realised through a Luxembourg-based Partnership are taxable in Luxembourg whether the partners are resident or non-resident.

Private individuals, who are Partners, will be taxable at the progressive individual income tax rate. Companies are taxable at the corporation tax rate applicable in Luxembourg.

Partners will be treated as resident tax payers and will therefore benefit from all exemptions available under the LTL.

There is no additional benefit of creating a Permanent Establishment (PE) in Luxembourg. This means that any activities realised by the Partnership outside Luxembourg, or realised through a PE abroad (or deemed to be realised abroad under the terms of a double tax treaty) will not be considered attached to the Luxembourg PE and will therefore not be taxable in Luxembourg.

Commercial Activities outside Luxembourg

When a Partnership does not have PE in Luxembourg and profits are made from Commercial activities, the partners do not have to pay tax on the profits as long as they do not pay tax in Luxembourg because they are a non-resident.

If a partner is a tax payer in Luxembourg, a portion of the profits realised by the Partnership will be taxable depending on the Partnerships statutes (either in proportion to their stake in the Partnership or depending on the way the profits are attributed in the Partnership statutes).

The above is subject to the application of double tax treaties. For instance, if the Partnership has a branch abroad, in a double tax treaty country, the Luxembourg-based Partner might be liable for tax in that country only and may be tax exempt in Luxembourg on profits derived from the foreign branch.

Lucrative Activities

For Lucrative Activities deemed taxable in Luxembourg ), the same rules apply as for Commercial Activities . Double tax treaties may also be relevant.

For Lucrative Activities deemed not taxable in Luxembourg (for example. holding shares in foreign private equity, holding a yacht/plane, an estate abroad, a portfolio of securities, in Luxembourg or abroad), two options can be considered:

-

If the Partnership is managed by one (or more) General Partners and is a Luxembourg commercial company holding more than 5% shares in the Partnership's share capital, then, partners' profits are taxable in proportion to their stakes in the Partnership, or depending on the way the profits are attributed in accordance with the statutes of the Partnership.

-

If the Partnership is managed by any other type of General Partner then profits are not taxable in Luxembourg at all. (They might however be taxable in the country of residence where the non-resident Partner is a tax payer; but double tax treaties may apply and/or may grant exemptions.)

Should the Lucrative Activities be linked with a PE situated abroad, in a double tax treaty country for example, then they might be exempt of taxation in Luxembourg as well.

Lucrative Activities not deemed taxable in Luxembourg but derived by a Partner who is a taxpayer in Luxembourg, will become taxable for that Partner under the Luxembourg taxation system. Not all Lucrative Activities are subject to tax under the Luxembourg tax system. There are, for example, exemptions on dividends, taxation at a flat rate on some types of interest income (RIEU), and exemption on capital gain for some participations.