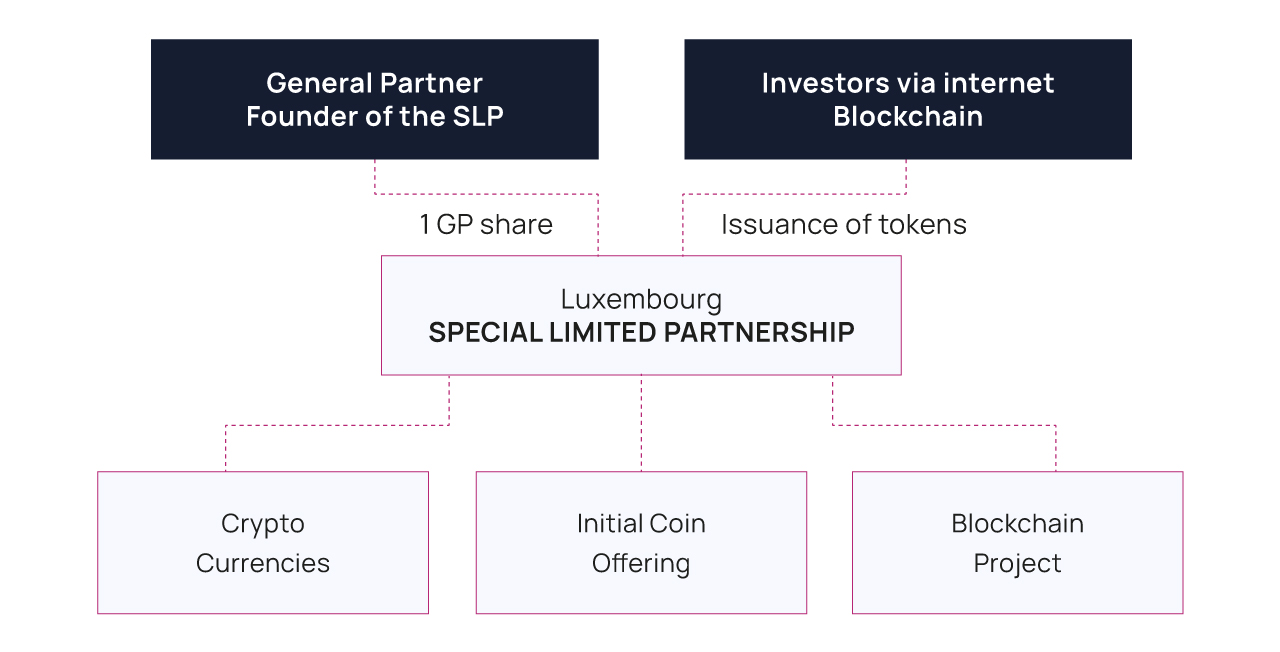

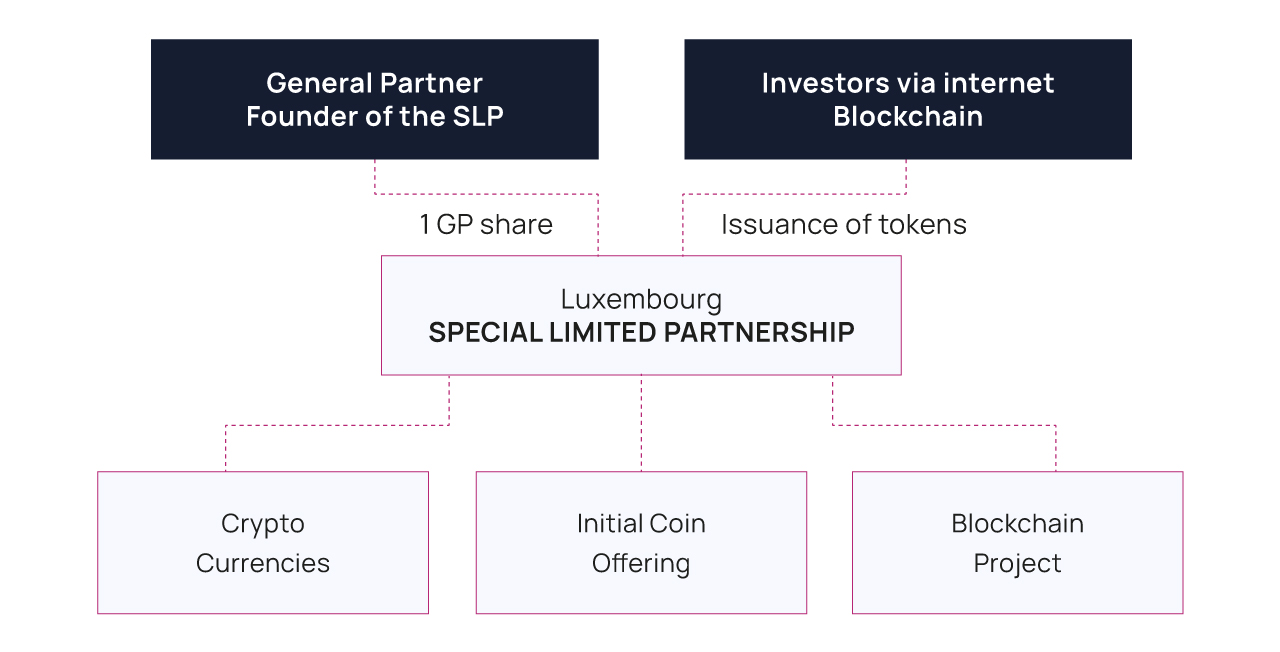

The SLP can be used to setup up a Crypto Fund as an Alternative Investment Fund

Crypto Funds

With the rise of the crypto currencies, investment managers have created Alternative Investment Fund to invest or trade crypto currencies (ETH, BTC, etc), to grant loan to traders, to invest in companies active in this sector, staking, etc.

Such so-called Crypto Funds can be setup as an unregulated Special Limited Partnership within a couple of weeks and remain unregulated if their manager’s AUM remains below 100 Mio eur.

Such Funds can also invest in “Tokens”, participate in ICOs, SAFT, invest in companies active in the Blockchain industry (private or public).

The SLP (Special Limited Partnership) is a flexible and fast solution for Alternative investment strategies.

Initial Coin Offering (STO) Process:

An ICO / STO is a fundraising method, operating via the issue of digital assets exchangeable against cryptocurrencies (or fiat money ) during the start-up phase of a project .

The issuer prepares a White Paper which consists of a document in which the underlying project is explained by its promoter.

Components of an offer:

- Project details

- Project timelines

- Amount of capital required

- Tokens (financial instrument)

- Dividend to be paid per token to investors

The next stage is the marketing campaign in which the issuer will promote their project to reach the initial capital.

BLOCKCHAIN TECHNOLOGY

Blockchain is the first radical technology innovation of the 21st century. It provides a secure ledger system which is distributed across various network participants. This provides a highly secure accountancy system which is hardened against unauthorised use and advantages as:

Security: Blockchain aims at increasing the security of the system from hacking and fraud.

Easy to use : It provides an easy mechanism to allow users to securely transfer the currencies or assets between them and facilitates easy audit of user accounts.

Flexibility: Using a blockchain technology does not mean that the system will need to be a public ledger or open system if this is undesirable. It can be restricted to some users.

Privacy: The system may remain totally private if desirable. There are key differences between public and private blockchains .

Accounting : Blockchain provides a powerful accounting/auditing layer.

Malleable technology: Blockchain assets are currently unregulated, helping minimize management costs and expand the possible user base and distribution channels.

Any Assets can be “tokenized” or placed on Blockchain :

- a security, (bonds, shares, funds, warrant, options, etc)

- a currency, (or a crypto currency)

- a movable asset, (car, plane, boat, etc)

- an intellectual property right or even

- real estate.

They can all be held by a securitisation Special Purpose Vehicle. (SPV)

This SPV can then issue “Token” which is a debt security which can be traded in a blockchain (private or public).

Once the Token is issued it can be traded on a stock exchange or transferred to any participant to this exchange.

Creatrust provides promoter with advisory services which include:

-

Fund setup and incorporation

-

Structuring crypto notes

-

Clearing with Clearstream/Euroclear

-

Central Administration services

-

N.A.V Calculation

-

AML/KYC and reporting

-

Access to our platform FundNav.lu

Read also: