- By Sector

-

Corporate

-

Corporate Clients

- Corporate Services

- Company Incorporation and Set-up

- Company Domiciliation and Administration

- Repository services

- Supply Chain Management

- Transfer Pricing Services

- Bond Listing Markets in Luxemberg

- Transfer Agent – Paying Agent – Fiscal Agent – Calculation Agent – Listing Agent

- Luxembourg tax regime for highly skilled expatriates

- Accounting, Legal, Corporate and Tax Advisory

- Payroll Services

-

-

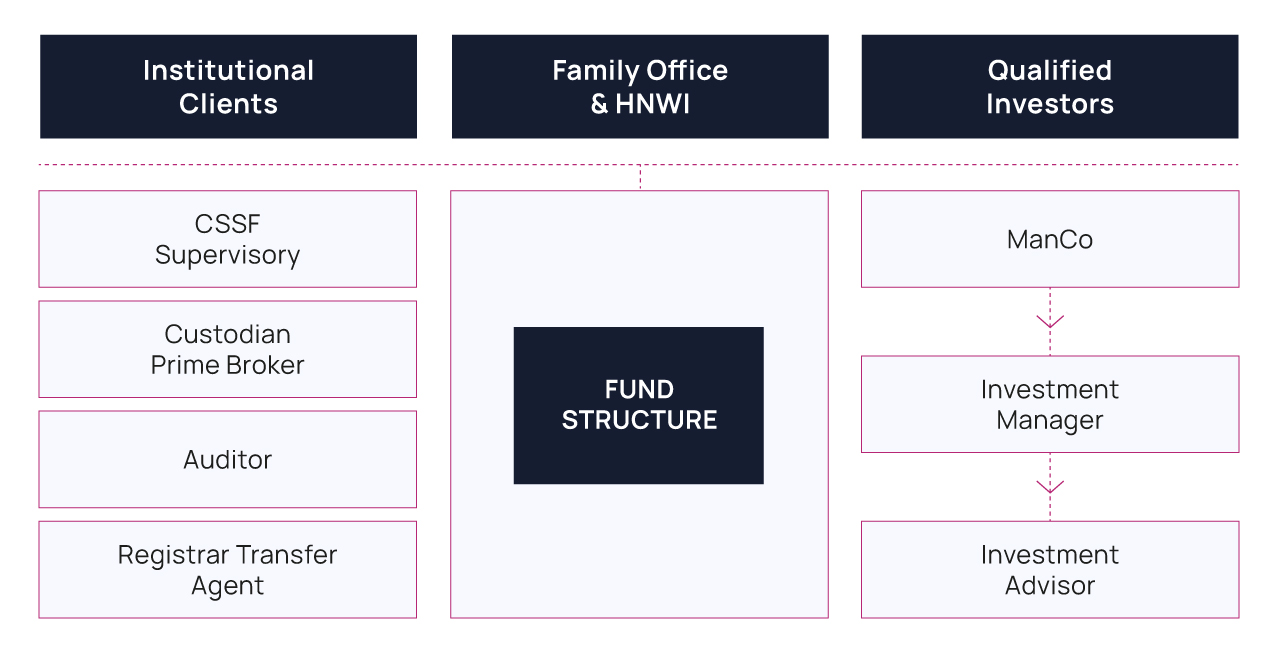

Fund

-

Fund Platform

- Venture Capital & Private Equity

- Special Limited Partnership (SLP) as an Alternative Investment Fund

- Specialised Investment Fund (SIF)

- Reserved Alternative Investment Fund (RAIF)

- Capital Risk Fund (SICAR)

- GP Accounting in Private Equity Funds

- Crypto Fund / Blockchain

- Special Limited Partnership Capital Account

- Pledge Fund

- Parallel Funds

-

-

Family office

-

Family Offices

-

- Publications

- About us

- Contact

-

- By Sector

-

Corporate

- Corporate Structure

- Capital Raising Solutions

- Corporate Actions & Activities

-

Corporate Services

- Company Incorporation and Set-up

- Company Domiciliation and Administration

- Repository services

- Supply Chain Management

- Transfer Pricing Services

- Bond Listing Markets in Luxemberg

- Transfer Agent – Paying Agent – Fiscal Agent – Calculation Agent – Listing Agent

- Luxembourg tax regime for highly skilled expatriates

- Accounting, Legal, Corporate and Tax Advisory

- Payroll Services

- Fund

- Family office

- Publications

- About us

- Contact