Investment Management expertise available to institutional, private investors and Family Offices

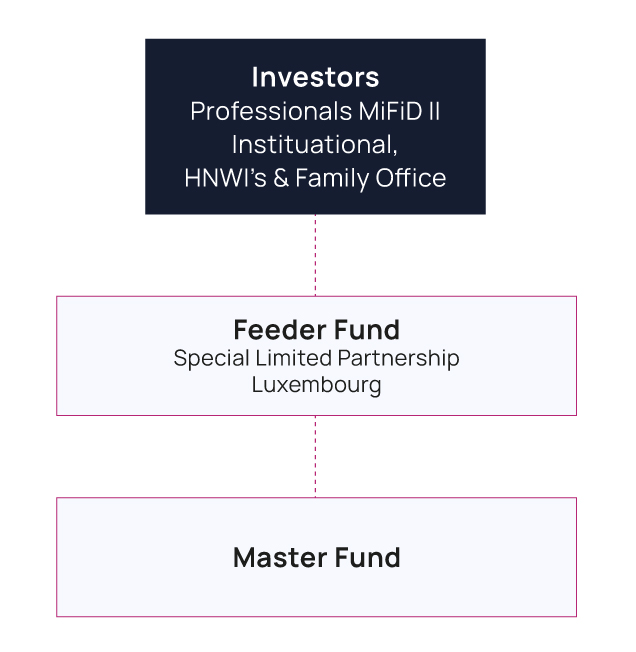

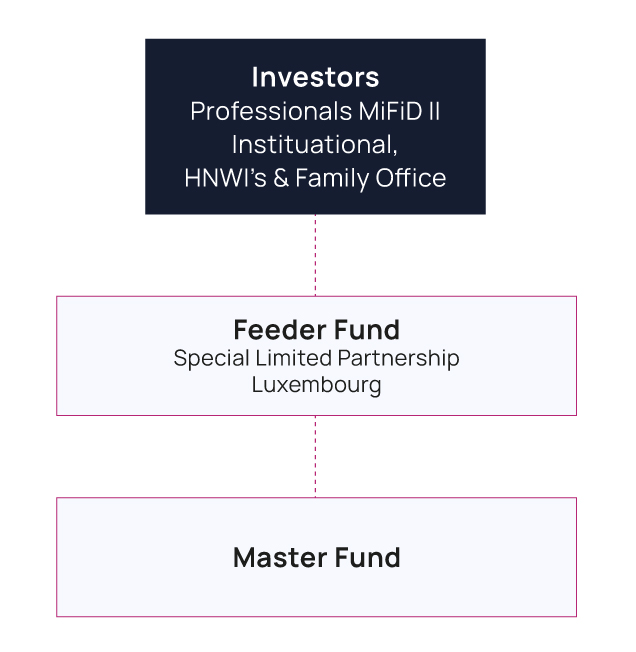

A master-feeder fund is a common special purpose entity utilised to raise capital or subscription from investors into a centralised vehicle known as a master fund.

Separate investment vehicles also known as feeders are established for each group of investors.

The feeder funds invest their assets into the master fund which is then responsible for making all portfolio investments and/or conducting the investment trading activity.

Feeder funds investing in the same master fund have the option of choice and variation which means that they may differ in:

-

investor type : eligible investor or institution or qualified or per country

-

fee structures : management fee, distribution fee, performance fee,

-

investment minimums : public, retail or professional

-

net asset values

-

and various other operational attributes : lock up, gate, etc.

This entails that feeder funds do not have to stick to a specific master fund but can function legally as independent entities with the ability to invest in numerous different master funds.

Management and performance fees are usually paid at the feeder-fund level but can also be paid at the master fund level.

Advantage of the structure:

The most important advantage of a master-feeder fund structure is the consolidation of various portfolio into a single one, usually for regulatory reasons.

This allows significant reductions in terms of operating and trading costs

Furthermore, it also enables economies of scale based on a larger portfolio which results in better options in terms of services and prime brokers.

Creatrust services for Master Feeder and Promoters are :

Read also: