Luxembourg has introduced a bill of law to create a Luxembourg Private Foundations - Fondation Patrimoniale.

In recent years, Luxembourg has made considerable efforts to develop its financial market with a range of legal instruments which seek to respond to the legitimate needs of both private clients and professionals active in the financial sector of asset management. In order to strengthen the position of Luxembourg as a financial centre of excellence in Europe - for the management and administration of family wealth - it is proposed to complete this range of instruments with a new vehicle to facilitate estate and succession structuring and planning.

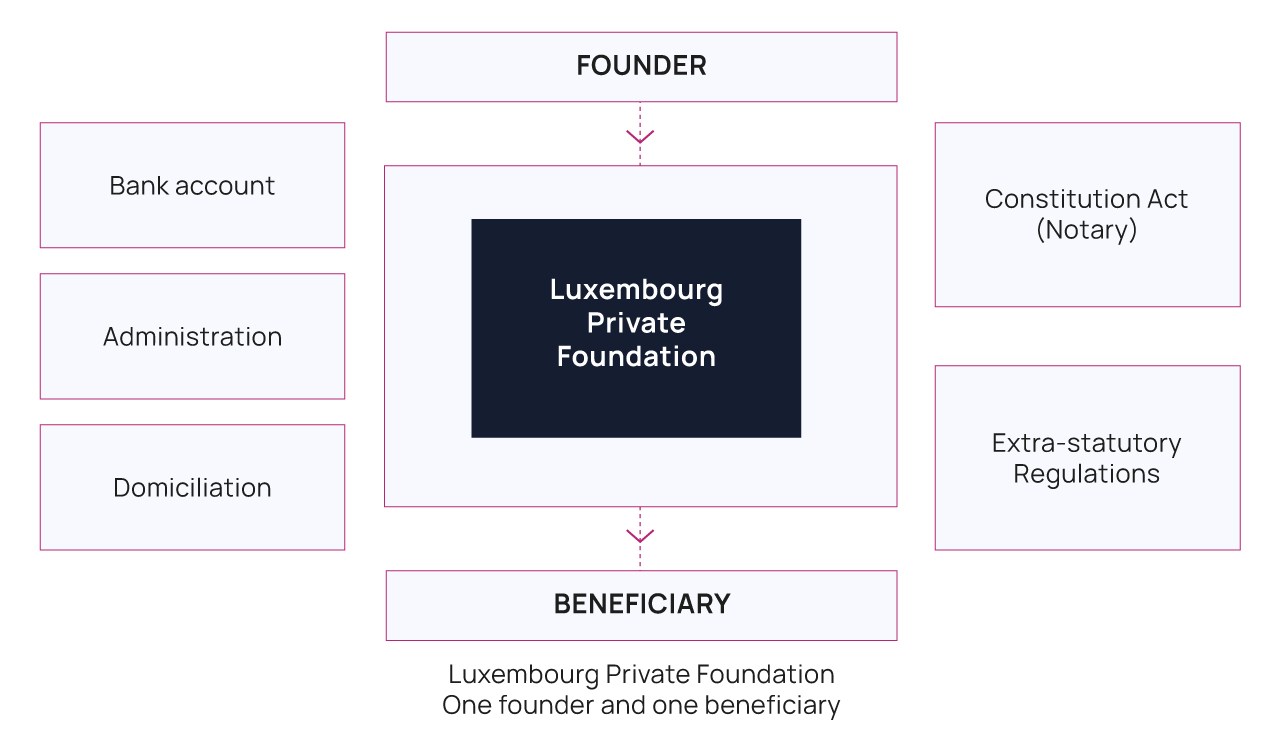

As a result, the bill introduces an orphan structure called the "Luxembourg Private Foundation" into Luxembourg law, as an addition to company and contractual solutions (e.g. fiduciary contracts, insurance contracts) commonly used in estate and succession structuring and planning.

A private foundation is defined as an instrument reserved for individuals or wealth structuring entities whose purpose it is to administer private wealth. It cannot be used to exercise a commercial, industrial, agricultural or professional activity.

The Luxembourg legislator has paid special attention to ensuring that the patrimonial foundation meets the requirements of the Financial Action Task Force (FATF) and the Global Forum on transparency and exchange of information for tax purposes. The Bill contains specific requirements concerning the identification of beneficial owners of private foundations, the availability and filing of information about the identification and accounting, as well as cooperation with the competent authorities. The Bill seeks to fulfil the requirements contained in the revised recommendations adopted by the FATF Plenary in February, 2012, seeking in particular to improve the transparency of legal persons.

The concept of the private foundation is already known in many jurisdictions such as Germany, Austria, Belgium, the Netherlands and Switzerland.

High net worth Individuals and wealthy families have used the private foundation for a number of reasons including:

-

The cohesion of the family patrimony: the private foundation can be used as an instrument to prevent the dispersal of assets in the event of death of a member of the family. The creation of a private foundation becomes an instrument of succession planning to ensure the continuity of a patrimony or even a family business, and to maintain or enhance the long-term family wealth;

-

Continuity in the management of the company: the foundation allows the separation of economic ownership of family property and the management of the family business. This is particularly useful when the founder has no children, if he considers that some of the heirs are not suitable, or heirs do not want to run the family business. It also allows a family business to move towards a more open structure to attract new capital and talent;

-

The protection of privacy and family safety: the private foundation can meet the legitimate needs of wealthy families to limit the visibility of their assets, ensuring their safety and the safety of any children (Dutch foundations, for example, are often used for this purpose by wealthy Dutch families).

The Luxembourg private foundation has similarities with a number of institutions in neighbouring countries, but should not be considered the same as them. Thus, if the provisions governing the new corporation are, to a large extent, based on the law of 10 August 1915 on commercial companies, especially those applicable to share companies (Société Anonyme or S.A.), the fundamental difference is that the patrimonial foundation is an orphan structure which has no shareholders, partners or members. The absence of a general assembly has a significant impact on the operation of the foundation. For example, the rules relating to altering the constitutional documents and to the approval of the accounts or the discharge of the directors (which typically fall to the general assembly), cannot be taken from the law of 10 August 1915. This fundamental distinction between the private foundation and corporate structures also affects estate transmission: while stocks or shares of a company remain in the patrimony upon death, capital grants of a patrimonial foundation are considered as having left the patrimony during the lifetime of the founder.

The Private Foundation, on the contrary, is a tool for estate structuring and planning.

The Luxembourg private foundation also distinguishes itself from foundations governed by the law of 21 April 1928 - on associations and non-profit foundations - because while such vehicles pursue philanthropic, social, religious, scientific, artistic, educational, sports or tourism goals, certain controls are maintained by the Minister of Justice.

So, a private foundation, can be seen as a tool for estate structuring and planning. The overarching purpose is, therefore, the management and administration of an estate for the benefit of one or more beneficiaries, or for the benefit of one or more goals, other than those reserved for non-profit foundations. A patrimonial foundation is not limited to pursuing charitable and non-profit activities, but it should not be incorporated to perform the type of specific goal reserved for non-profit foundations. For instance, safeguarding a specific art collection as part of a family's private wealth would fit the patrimonial foundation. Finally, the foundation is not subject to the supervision of the Minister of Justice.

The Bill seeks to reconcile two principles, namely, on one hand, the autonomy of the will of the founder and on the other, the protection of the patrimony of the patrimonial foundation and, ultimately, of the beneficiaries. The latter is particularly important given the orphan nature of the patrimonial foundation. Thus, in principle, the founder has a great deal of freedom to draft the constitutional acts and extra-statutory regulations. However the Bill imposes certain restrictions designed to protect beneficiaries; in particular by prescribing provisions regarding the liability of the administrators and liquidators, through the information which must be held at the headquarters of the foundation and by limiting the changes which can be made to the constitution's acts.

Moreover, it is foreseen that private foundations which do not have their own offices are to be domiciled with a professional domiciliation company under the modified law of 31 May 1999 on the domiciliation of companies. The amended law of 31 May 1999 has thus been modified in this end.

The 2013 Bill also defines the tax regime applicable to the Luxembourg private foundation. With regards to indirect taxes, the introduction of a special registration fee has been proposed in line with the rates currently applied to inheritance. This is to avoid unequal treatment between persons whose entire patrimony falls upon death into succession and people who, during their lifetime, have chosen to transfer part of their patrimony to a patrimonial foundation.

The result of this is that the registration fee becomes payable on the net assets of the private foundation upon the death of the founder. It should be noted that "net assets" are limited to the real estate assets located in Luxembourg in case of death of a founder who has lived abroad. The transfer of assets or property to the private foundation gives rise only to a fixed registration duty.

The removal of assets is taxed as a gift provided it is done during the lifetime of the founder. The common regime on gifts is applied in this case.

In relation to direct taxes, the Bill establishes the patrimonial foundation as a separate taxable entity independent of the founder or his dependents, beneficiaries or administrators.

Step-up Principle

Finally, the bill introduces the "step-up" principle in respect of securities relating to a substantial holding held by an individual who becomes a resident taxpayer in Luxembourg and sells these securities thereafter. The aim of this principle is to avoid double taxation of the capital gain to the extent that it was generated before the date of the establishment of the tax residence in Luxembourg.