A solution for simpler transactions - Deal by Deal

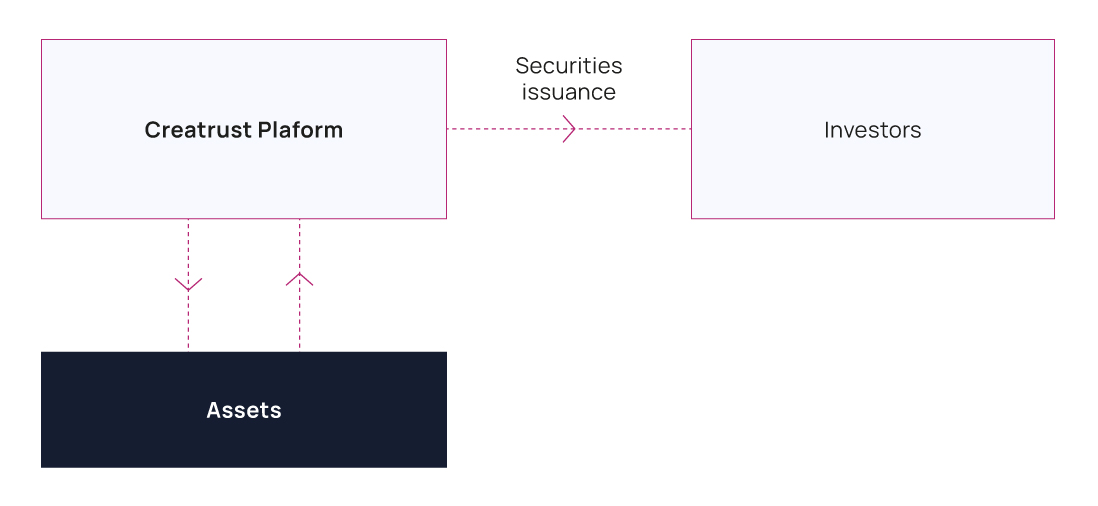

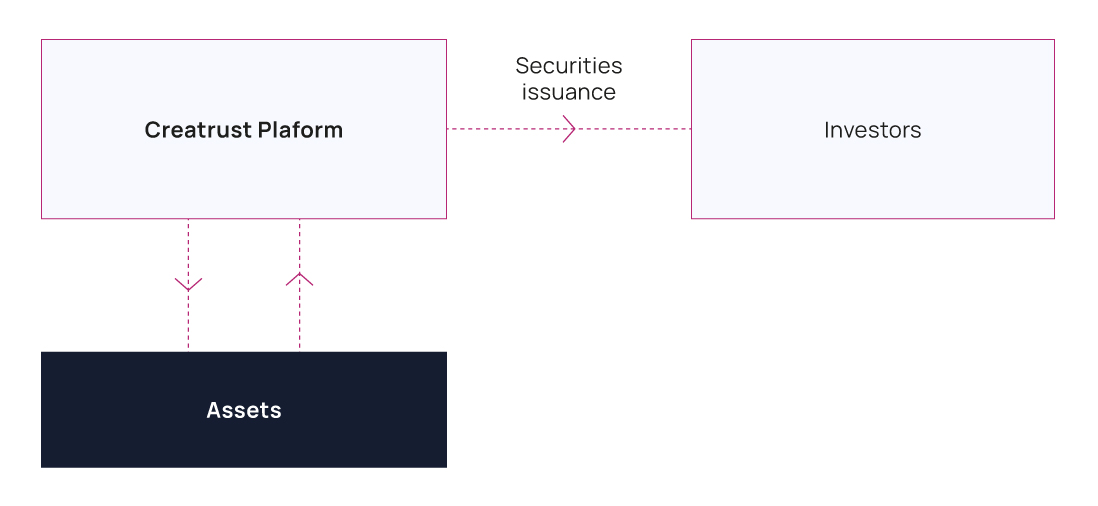

The securitisation process proposes to investors to buy securities in order to obtain the proceeds from the investments made by the securitisation vehicle into specific underlying assets.

Securitisation vehicles gather assets producing a predictable cash flow or granting the right to a future cash flow, and transform these assets into securities (shares, bonds or other securities).

One qualifies these securities as Asset Backed Securities (ABS) because the underlying assets serve as collateral for the investment. Then the investor carries two risks: the uncertainty of a future cash flow and the risk of valuation of the underlying asset.

All types of investors, institutional or individual, can use securitisation.

Also, a vast array of assets can be securitised: securities (like shares, notes or bonds), movable and immovable property (tangible or not), but also risks linked to debt, like loans, mortgages, commercial. More generally, it concerns any cash flow linked to a business or an activity having a certain value or future income.

In Luxembourg, securitisation vehicles my take the form of regulated or unregulated securitisation companies or securitisation funds. The Luxembourg law ensures the tax neutrality of securitisation vehicles.

Two solutions are therefore offered to investors:

This solution offers the advantage of having a dedicated structure for specific securitisation transactions.

This platform accommodates our Creatrust Fund. It allows the issuance of securities linked to a specific underlying asset, as mentioned above for a particular individual or company investor. This Platform is used for simpler transaction and can be set up within a couple of days. The costs to securitisation such assets via this platform are +/- 0,10 % of the assets under management.

Read also: