AMCs - Managing wealth while issuing notes

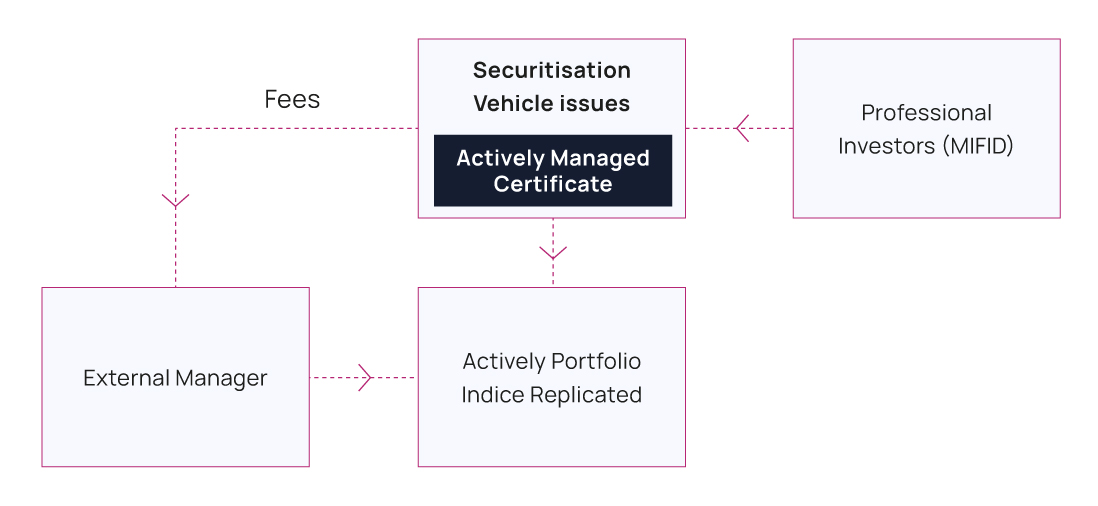

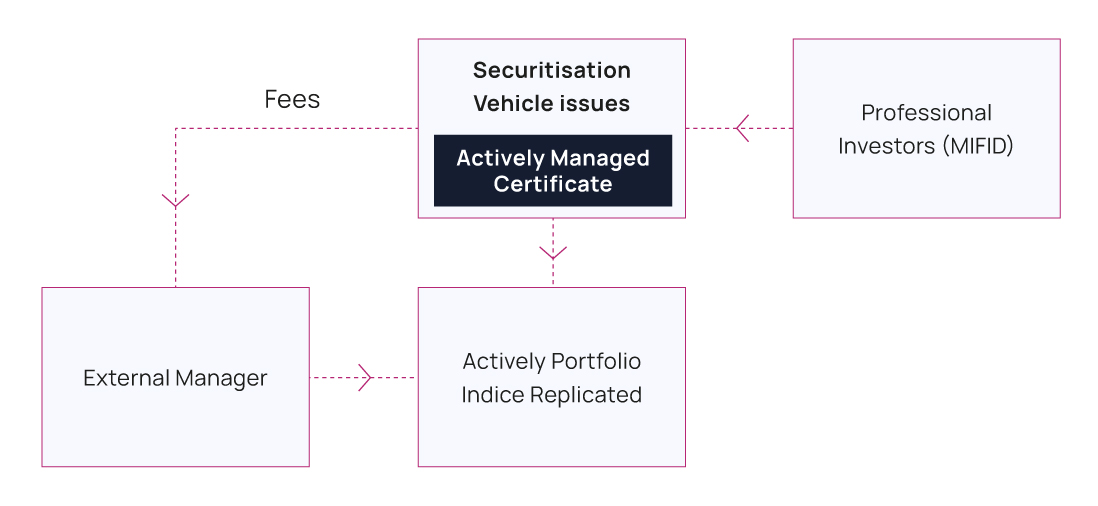

An Actively Managed Certificate (AMCs) is a debt instrument issued by a Special Purpose Vehicule as a structured product comprising a portfolio of underlying assets (liquid securities, bonds, funds, shares, derivatives, currencies, etc.)

Usually the AMC follows a defined composition of underlying assets or an index which changes over the time at the discretion of an external asset manager.

AMCs enable a very fast time to market when the external asset manager decides to create its own strategy.

AMCs offer great flexibility and the asset manager has the ability to develop, engineer and test its investment strategies at a very reasonable costs compared to other investment vehicles.

The strategy’s performance is tracked by calculating the value of a synthetical strategy-basket (or tailor-made index) that consists of individual notional strategy-components which are actively selected.

General Rules for Structured Products

AMCs are subject to the general rules for structured products which are usually only distributed to Professional investors.

The description of AMCs in a simplified memorandum/prospectus must include information on the basic parameters of the strategy.

-

criteria for the selection of strategy-components,

-

information on the handling of the income of such underlying values

-

strategy guidelines

-

the leverage applicable on the strategy

-

the Asset manager in charge of the strategy and its compensations

-

notes describing the accessibility of the information related to the composition and strategy

Furthermore, AMCs need to be clearly distinguished from collective investment schemes (AIF) and include a general disclaimer which must be highlighted in the simplified prospectus. The main reason for this differentiation is due to AMCs being subject to the issuer risk.

Creatrust Services to issuer of AMC via a Luxembourg SPV:

-

Analysis of Waterfall

-

Security Issuance

-

Debt and Bond Investment Memorandum

-

Central Administration

-

Communication to Investors

-

Advisory, reporting, incorporation.

Please find more information about our Securitisation services on our dedicated website: luxembourg-securitisation.com

Read also