Limited Partner Capital Account

Partnership Interests may (or may not) be represented by securities, depending on the terms of the Limited Partnership Agreement.

Another method is to have Partnership's Interests represented by a percentage (%) of the equity (and the distribution) of the Partnership.

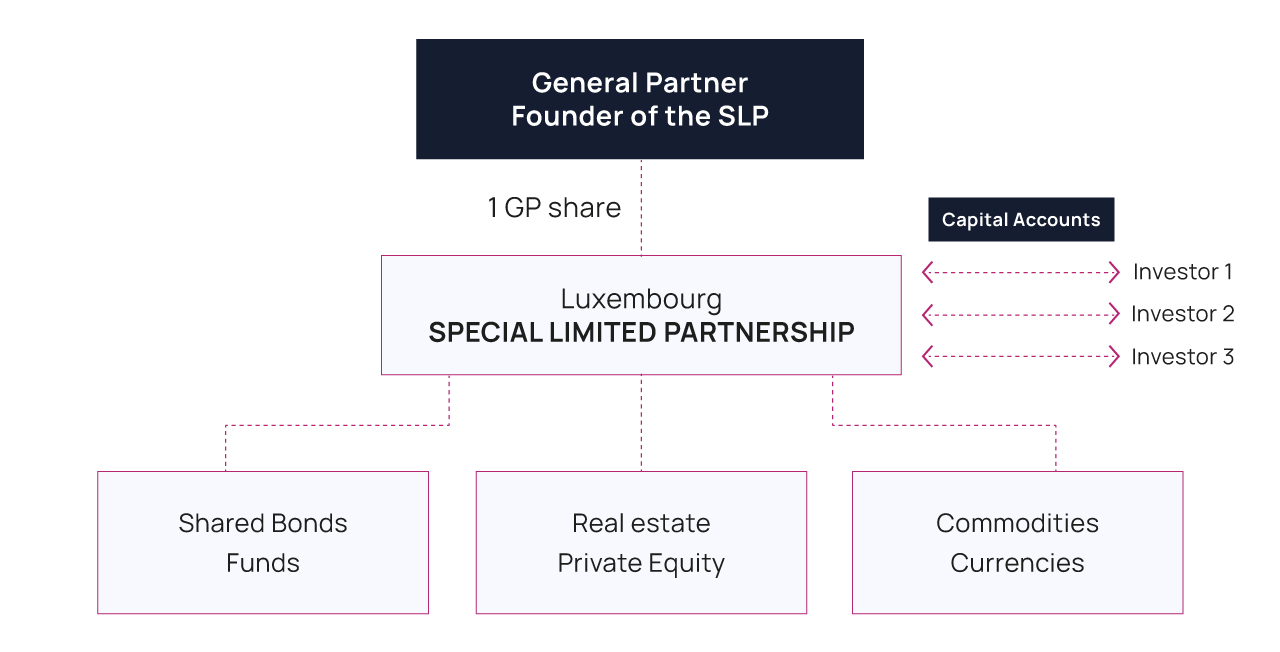

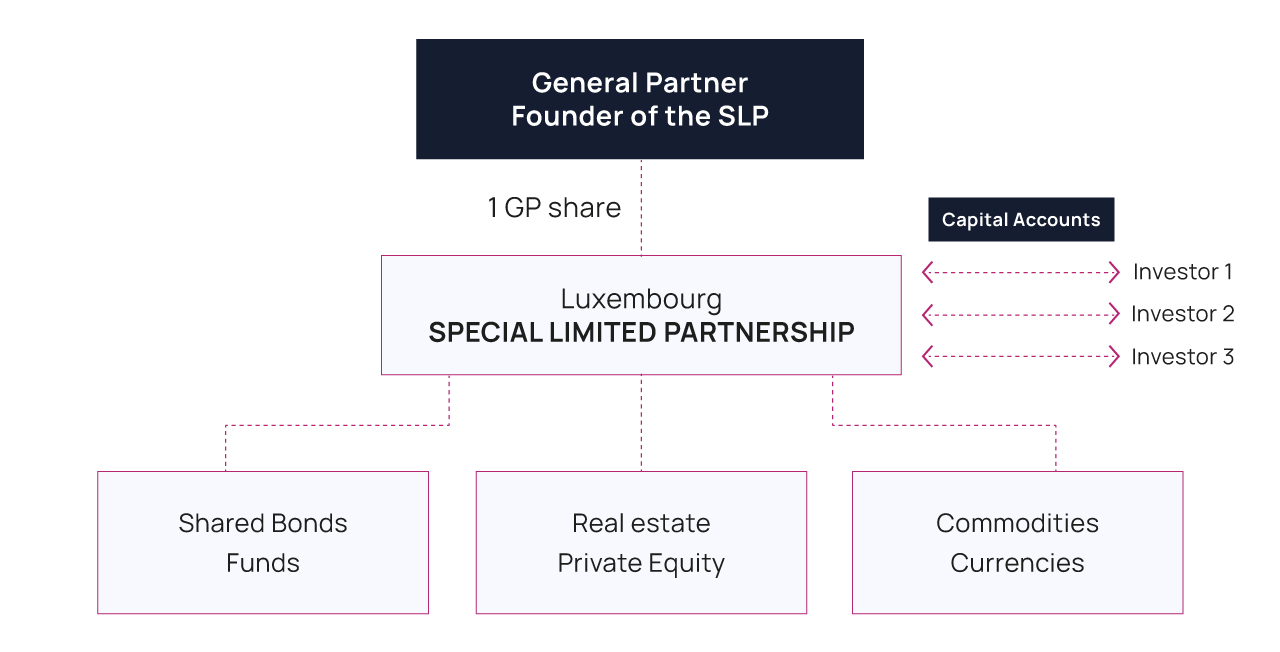

Some limited partnerships do not issue securities to their investors, each Limited Partner would then contribute to the Limited Partnership in a Capital Account.

The Capital Account of a Limited Partner grows and declines further to:

- contributions and withdrawals of capital/moneys by the Limited Partner

- profits or losses of the Limited Partnership allocated to that particular Partner

The manner in which allocations of realised and unrealised gains and losses, together with income and expenses, are made is governed by the Limited Partnership Agreement or any other terms and conditions previously negotiated with each Partner(s).

Structuring the participation of Limited Partners in a Limited Partnership by way of Capital Accounts rather than through the issue of securities may be attractive for several reasons.

Advantages of Capital accounts

In particular, capital accounts allow more flexibility in accommodating the requirements or constraints of individual investors. With capital accounts, it is possible for instance to cater for specific fee arrangements or adapt the portfolio of an investor according to his specific needs.

In such a case, the Partnership does not issue securities and no prospectus nor memorandum should be drafted.

There are no statutory restrictions on issues and reimbursements of partnership interests. Limited Partnerships may operate on a variable capital basis allowing capital contributions to be increased or decreased during the life of the Limited Partnership or to be payable in installments as required for investments.

Instead of having shareholder/Partners like in a classical Limited Partnership the Capital Account would be working as follows:

Read also :