Effective management of assets for High Net Worth Individuals and members of family offices through Luxembourg

Whether it's a large apartment in New York, a chalet in Courchevel, a private jet or a superyacht moored in the Mediterranean, all such assets must be taken care of. HNWIs may own these assets through various structures, depending on the asset's status, size, use and the tax situation of the owner.

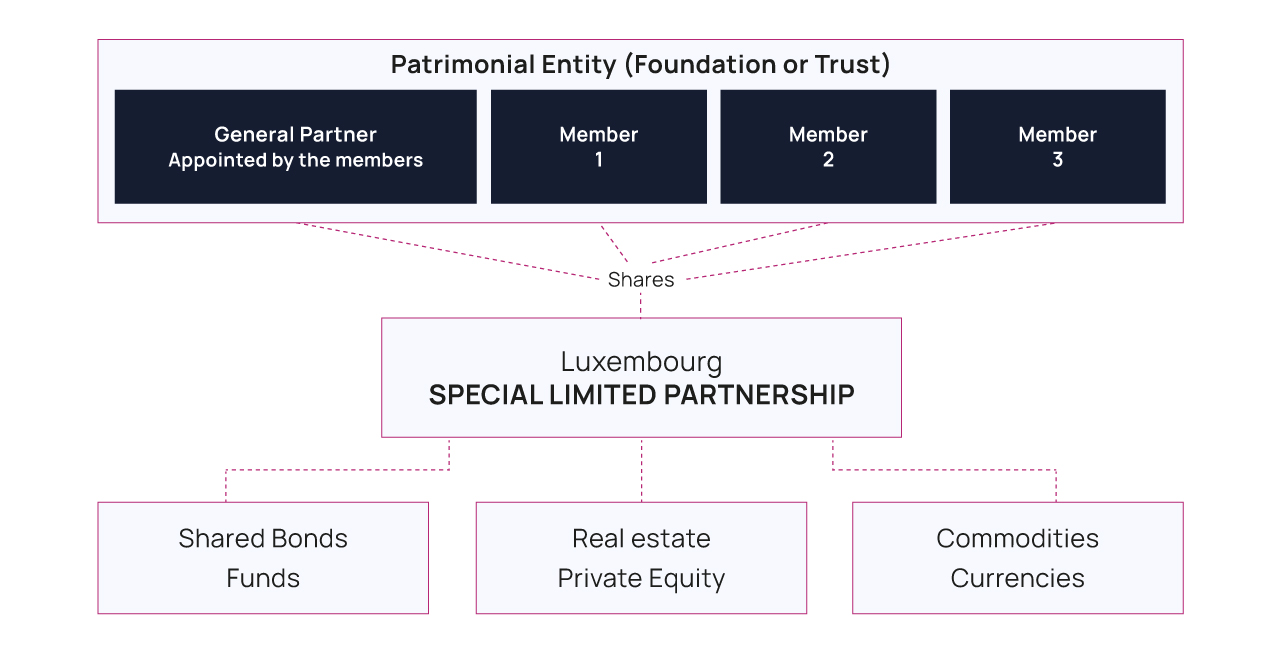

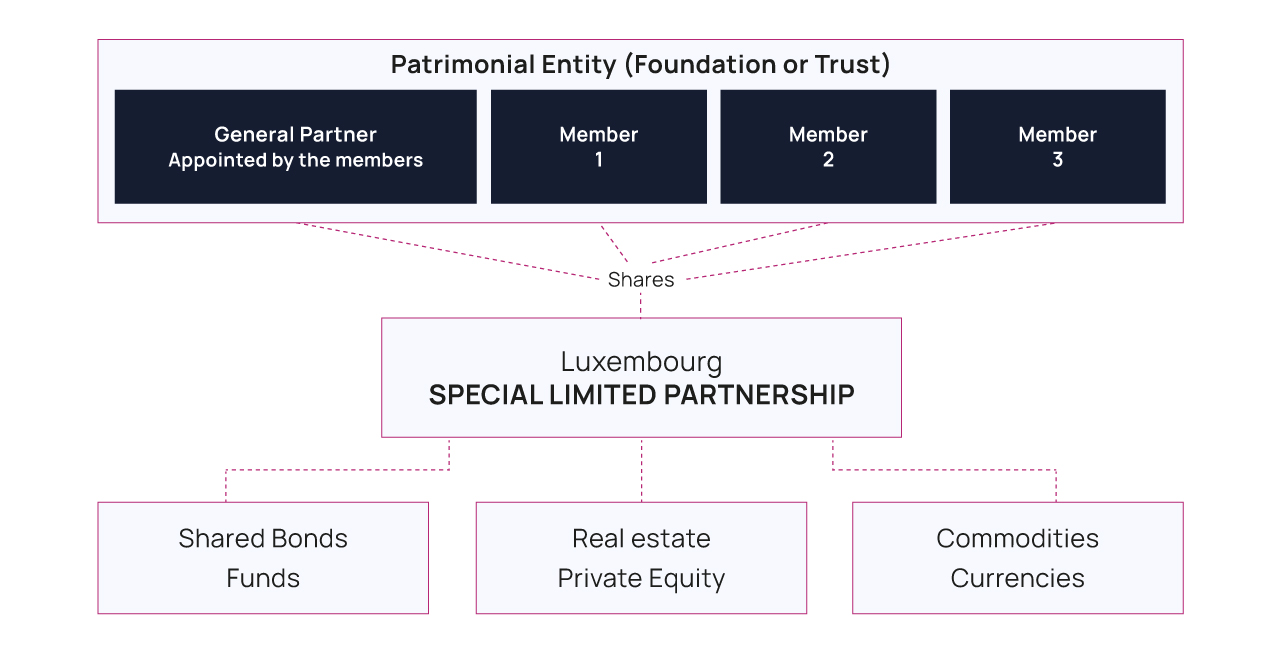

The Luxembourg Special Limited Partnership (SLP) for asset protection and estate management is an entity which can be set up easily and managed through Luxembourg to hold assets all over the world (aircraft, yachts and real estate).

-

The SLP can be held by an individual or a patrimonial entity, such as a trust or a foundation, wherever they are resident;

-

The SLP can also hold, other types of assets such as financial assets, IPR, etc;

-

Several members of a family office can hold shares in the SLP and be alloted certain rights, depending on their share in the assets;

-

One member can receive the right to use a particular asset and another member the right to use another asset of the SLP;

-

The right to a potential sale of one of the SLP's assets can also be attributed to one or several particular members of the SLP (father and sons, between two branches of a family, etc);

-

The entity can be adapted in any circumstance and amended from time to time as the SLP is set up as a contractual relation between the members;

-

The SLP is tax transaprent, not subject to tax in Luxembourg and thus not subject to corporation, duties, wealth taxes or any donation or inheritance taxation (assuming there are no Luxembourg resident members);

-

The members appoint a general partner who can be in Luxembourg or abroad;

-

A managing director can be appointed to manage all, or specific assets;

-

The financial statements are not published and access to them can be restricted among members, depending on the right they have in the articles of association.

Because of its flexibility and effectiveness, the Special Limited Partnership in Luxembourg is an entity which is often sought by high net worth individuals or family offices.

Creatrust, for wealth and asset administration

Creatrust helps Ultra High Net Worth individuals and family offices to create and maintain an effective structure for protecting and enhancing your wealth from one of the world's most favourable tax, fiduciary and regulatory jurisdictions, Luxembourg.

Clients benefit from ongoing technological innovations as well as the personal touch provided by our in-house experts to help you ensure that the future administration of your wealth, and that of your family, is in safe and capable hands.

Read also: