Regulated or unregulated securitisation companies and securitisation funds are defined under the Luxembourg securitisation act of 22 March 2004.

The Luxembourg law allows the securitisation of many types of assets, risks, revenues and activities and makes securitisation accessible to all types of investor (institutional or individual). Issuers will issue securitisation vehicles as an alternative to traditional bank funding.

An extremely wide range of assets can be securitised: securities (shares, loans, subordinated or non-subordinated bonds), risks linked to debt (commercial and other), movable and immovable property (whether tangible or not) and, more generally, any activity that has a certain value or future income.

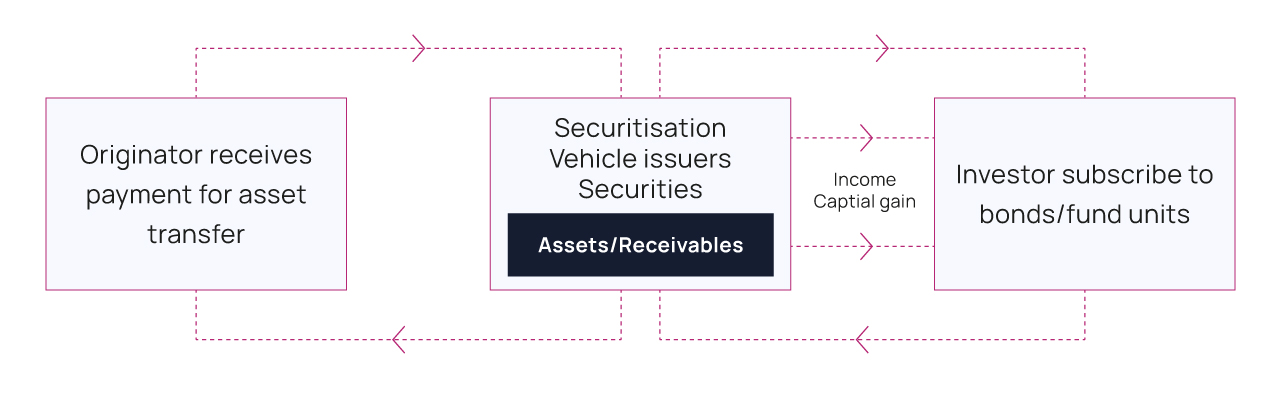

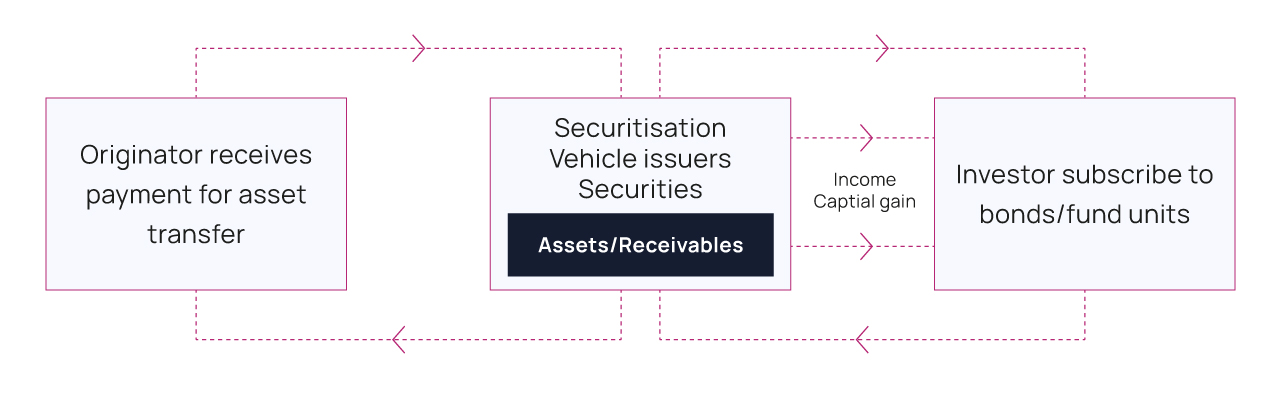

Securitisation process

Securitisation undertakings established in Luxembourg are incorporated by a promoter to securitise any type of assets or risks linked with receivables or any activities realised by third parties. The process of securitisation is understood as acquiring risks from an originator by issuing a security the value of which and associated yields are linked to the underlying asset.

Securitisation is an operation by which investors buy securities, i.e. transfer cash to a securitisation vehicle (SV), in order to obtain the proceeds from the investments made by that vehicle. SVs are assets that produce a predictable cash flow or grant the right to a future cash flow, transforming these assets into securities (shares, bonds or other securities). Investors, however, also carry the risk of any uncertainty in these cash flows.

These securities can be qualified as Asset-backed Securities (ABS), because the underlying assets serve as collateral for the investment. As such, the investor normally carries two risks: the uncertainty of a future cash flow and the risk of valuation of the underlying asset.

For example, a bank may decide to sell the risks associated with their real-estate loan portfolio to investors, thereby effectively removing this risk from their balance sheet. The buyer of these risks is entitled to the cash flow related to the interest paid by home owners and to the underlying homes in case of default of the home owners.

At the forefront of securitisation services in Luxembourg

Creatrust works to secure and advance the interests of clients and to provide services that help them transform their assets and financial futures:

-

In-house knowledge of all the major regulatory and development issues

-

Commitment to sourcing the most appropriate solutions for establishing and managing securitisation vehicles

-

Strong and open relationships with clients based on clear communication and trust

-

Independence

Creatrust provides a range of services for clients, including administration, tax advice and security issuance.

Please find more information about our Securitisation services on our dedicated website: luxembourg-securitisation.com

Securitisation vehicle: company or fund

Under Luxembourg law, a securitisation vehicle can be constituted either as a company or a fund.

A securitisation company must take the form of public limited company, a joint stock company, a private limited company or a cooperative with limited liability. It can create one or several compartments corresponding to a distinct part of its holding.

A securitisation fund has no legal personality and must be managed by a management company, which must be a commercial company. The fund is formed from one or several joint ownership organisations or one or several fiduciary estates. In the former case, the fund must be under a co-ownership regime, with the latter scenario being governed by trust and fiduciary contract legislation.

Luxembourg law ensures the tax neutrality of securitisation vehicles. Securitisation funds are treated as investment funds and the investors are taxed according to the rules in force in their country of residence. These funds are exempt from tax, but cannot benefit from double tax treaties agreed by Luxembourg.

Securitisation companies are fully taxable, but payments carried out on the behalf of investors are fully tax deductible (subject to ATAD1).

Securitisation companies may benefit from EU directives and double tax treaties.

Securitisation organisations that continually issue transferable assets for the public must be approved and supervised by the financial sector supervisory authority, the CSSF.

Types of assets acquired by a Securitisation entity

Examples of assets acquired by a securitisation entity:

-

Receivables, loans, mortgages, any future cash flow on sale of assets, current accounts

-

Bonds, shares, financial instruments, derivatives, currencies, precious metal, etc

-

Real Estate, planes, yachts, buildings, land, woods, plantations

-

Bank cards, car rentals, commercial, legal or political risks, catastrophe risks

-

Intellectual property, royalty income, future cash flow on activities, etc

Different Securitisation Entity's Forms

A Securitisation company can be incorporated in the following forms:

-

Public Company Limited by shares (SA or Société Anonyme)

-

Private Company Limited by shares (SáRL or Société à Responsabilité Limitée)

-

Limited Partnership (Société en Commandite par Actions)

- Cooperative companies limited by shares (Société Coopérative fonctionnant comme une Société Anonyme)

- Special Limited Partnership s (Société en Commandite Speciale)

A Securitisation Fund can be incorporated:

-

as a stand-alone fund, which is a contract of co-ownership between the investors, and

-

a management company which has a registered office in Luxembourg.

Both undertakings can be used as a Special Purpose Vehicle (SPV) and can be set up as an umbrella structure, with segregated compartments enabling the same vehicle to be used for different securitisation transactions.

Segregation, Ring Fencing, Bankruptcy remoteness, Synthetic Securitisation

The law offers statutory protection on a number of standard securitisation issues, for example bankruptcy remoteness, true sale vs synthetic securitisation, ring fencing, non petition and limited recourse on the undertaking assets (receivables etc).

Luxembourg Regulation

Securitisation undertakings (company or fund) are not regulated by the CSSF unless they issue shares or bonds to the public (less than EUR100,000) on a regular basis (once per civil quarter).

Both conditions are cumulative. This means that issuing securities in the public sphere once does not fall under the supervision of the CSSF.

Likewise, issuing securities to HNWIs, Family Offices, Institutional investors, or under a private placement is not deemed to be in the public sphere.

However, the appointment of an auditor is mandatory.

Tax framework

Luxembourg tax law attempts to achieve a regime of tax neutrality, as a securitisation vehicle should serve as a pass-through entity from the originator to the investors.

A Luxembourg Securitisation Company:

-

is subject to normal corporation tax at 26-27%

-

is not subject to a minimum wealth tax or incorporation duties on capital

-

will have all profits realized by the securitisation considered as normal taxable income,

-

However, all costs and commitments due to the undertaking shareholders and bondholders (or note holders) will be considered as tax deductible expenses (subject to ATAD1). This means that only the remaining profits of the Luxembourg securitisation company will be considered as a taxable profit in Luxembourg .

Dividends, interest (whether variable or fixed), coupons, options, or any other financial advantages that a third party may receive from the securitisation company will be tax exempt, and will not suffer any withholding taxes in Luxembourg (subject to ATAD 1).

A Luxembourg Securitisation Fund:

-

is considered tax transparent (Fonds Commun de Placement) and is therefore not subject to any taxation in Luxembourg. (The fund is not taxable itself and there is no withholding tax on payment to share or bond holders).

-

offers a profit to unitholders in the securitisation fund depending on their percentage of fund ownership.

Read also: