The term "alternative investment fund" refers to all investment funds that are not already covered by the European Directive, Undertakings for Collective in Transferable Securities (UCITS). This includes hedge funds, funds of hedge funds, direct lending, private debt, crypto assets, venture capital and private equity funds, and real estate funds.

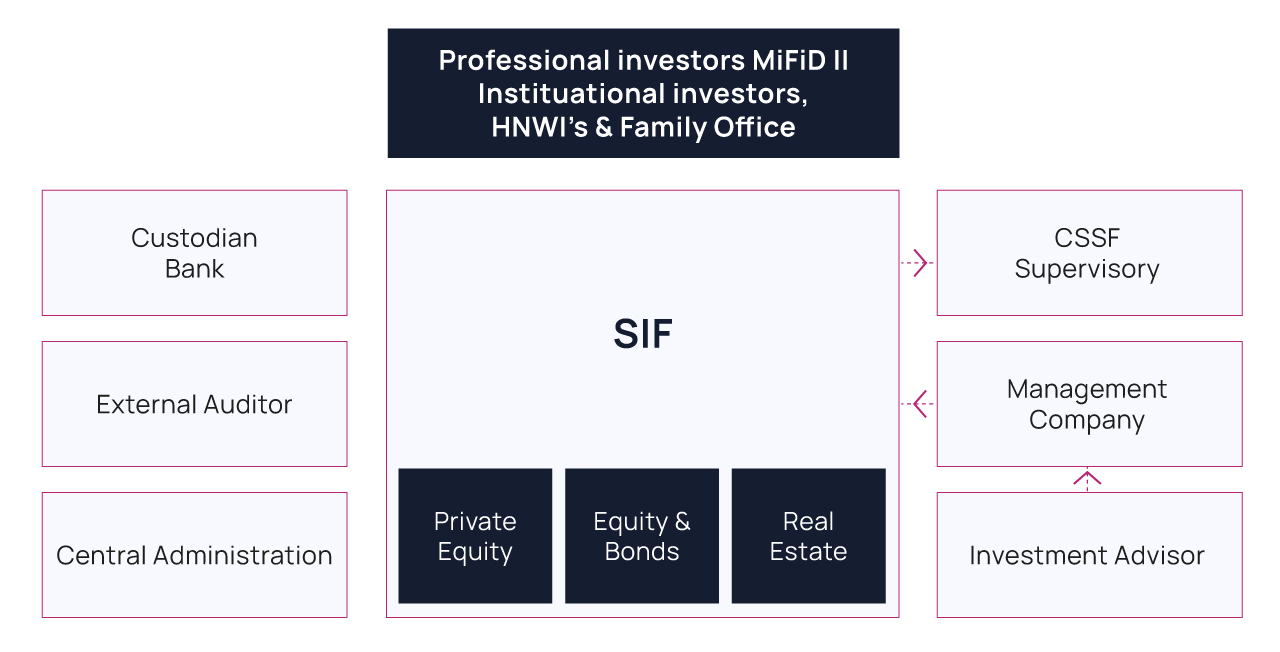

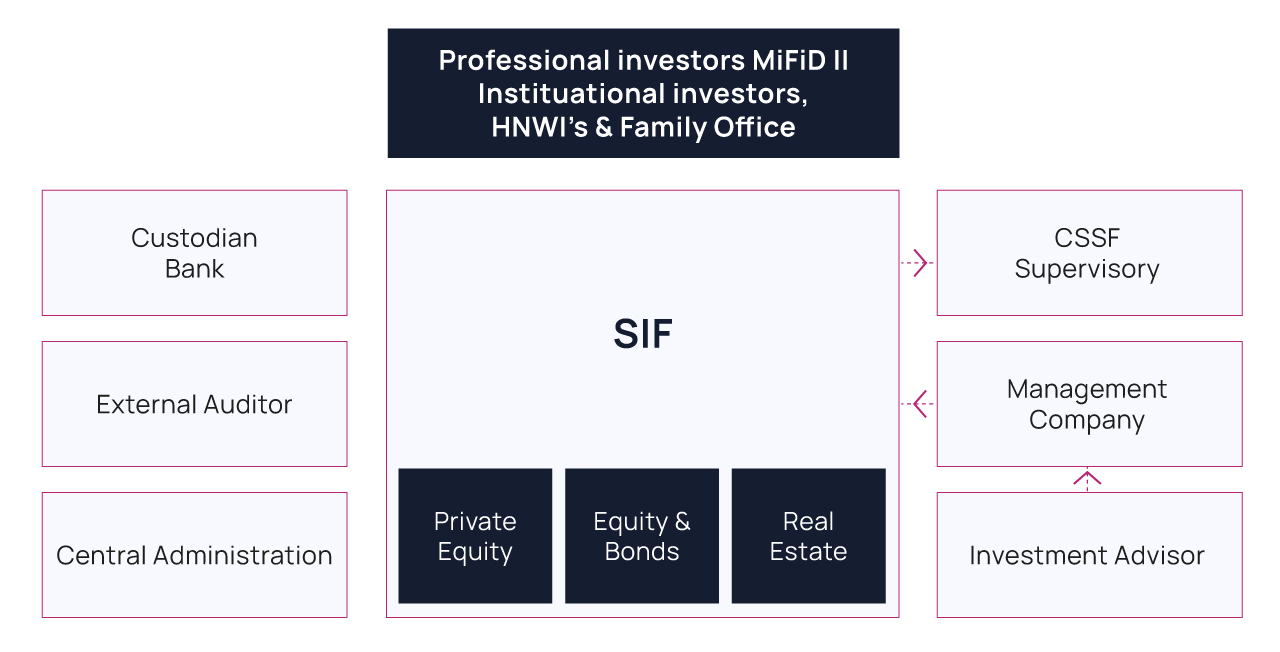

In the past, alternative investment funds were generally created under Part II of the Luxembourg law on investment funds. Then in 2007 a new law, created the Specialised Investment Fund (SIF), which provided an additional vehicle specifically designed for qualified international investors. This one was then followed by the regime of the Reserved Alternative Investment Fund. (unregulated)

There are no legal restrictions on the type of assets in which alternative funds may invest, but the investment policy must be approved by the financial sector regulator, the CSSF. The regulator has established requirements regarding risk diversification, but these are less strict than for UCITS. Alternative funds can adopt the same legal forms as a UCITS, that is:

-

a common investment fund (Fonds Commun de Placement - FCP) which has no legal personality and must nominate a management company;

-

an investment company with variable capital (Société d'Investissement à Capital Variable - SICAV) in which the capital changes as a result of investments and redemptions;

-

an investment company with variable capital (Société d'Investissement à Capital Fixe - SICAF)

The specialised investment fund (SIF) , the RAIF and the investment company in risk capital (Société d’Investissment en Capital à Risque - SICAR) can also be added to this list..

The SOPARFI (Société de participations financières), a company that undertakes holdings and financing activities, is often used for organising risk capital and private equity investments.

Such vehicles can be structured either as a "stand alone" fund with a single portfolio investment, or as a multiple compartment fund which, within a single legal entity, creates separate sub-funds (compartments) with different investment policies.

Each legal entity and each fund compartment can issue an unlimited number of share classes based on the needs of the specific investors to whom the shares must be issued.

Unlike UCITS, alternative investment funds do not benefit as such from the European "passport" which enables a fund to be sold throughout the EU once it has regulatory approval in one Member State. for RAIF for instance the EU Passport shall be granted depending on the countries where its AIFM shall be registered.

Luxembourg hedge funds may be regulated by the Financial Sector Supervisory Authority (Commission de Surveillance du Secteur Financier - CSSF); some others are not regulated.

Despite its relatively late start, Luxembourg is now catching up fast with off-shore fund centres. As the trend for regulation continues, the number of hedge fund managers who will choose Luxembourg for their investments, or perhaps even make the permanent move to Luxembourg, is likely to increase. Recent regulation has made residency in Luxembourg particularly attractive for managers from a fiscal point of view.

The Alternative Investment Funds in Luxembourg can be separated into the following categories:

Regulated funds:

Unregulated special purpose vehicles are:

Read also