A wide range of solutions to structure the capital raising activity

There are many ways to raise capital for new business, ventures or investment funds.

Luxembourg offers a wide range of solutions to allow corporations, promoters and entrepreneurs to structure their capital raising activity.

The creation of investment funds, being public funds and alternative investment funds, can provide interesting solutions, from venture capital, private equity hedge fund, real estate fund or listed equity investments fund.

Promoters also set up holding structure, like the SOPARFI, to pool their equity participations and finance subsidiary companies in Luxembourg or abroad.

But how does a company attract new capital, especially a smaller one? By issuing equity? Equity is a common way to attract new investors. Yet, equity also provides the investors with a share in the overall returns and potentially even decision influence or even control over a company.

The issuance of bonds and hybrid instruments allows Promoters to attract capital without giving away equity.

With the Creatrust turnkey solution for bond issuance, it is now possible to issue bonds and hybrid instruments for smaller and medium-sized enterprises as well.

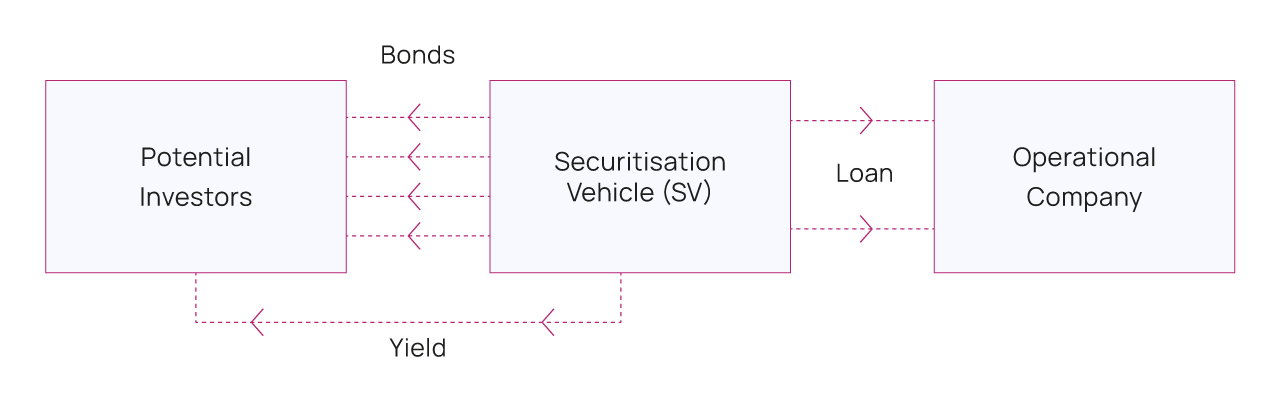

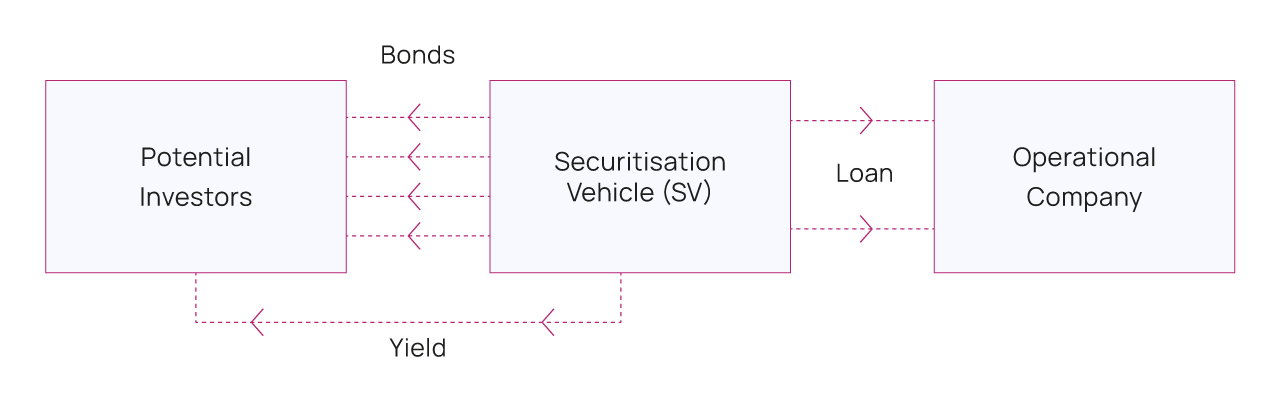

The issuance is structured through a securitisation vehicle, whereby a Special Purpose Vehicle is setup to securitise an activity or act as a first lender to the company in need of capital.

At the same time the SPV issues Bonds which are then subscribed by potential investors who then receive a yield which depends on the risk and value of the underlying activity, company or assets.

Please find more information about our Securitisation services on our dedicated website: luxembourg-securitisation.com

Please note that Creatrust does not offer capital raising or marketing services.

Read also: