Flexible solution to setup an Alternative Investment Fund in Luxembourg

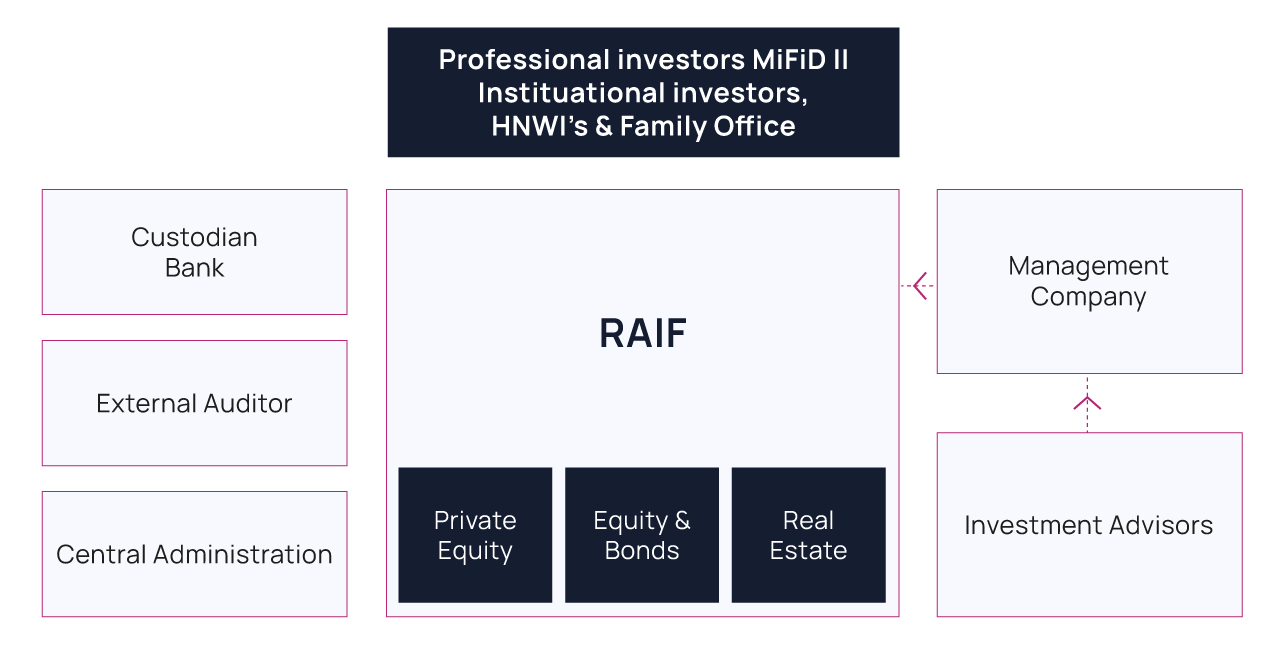

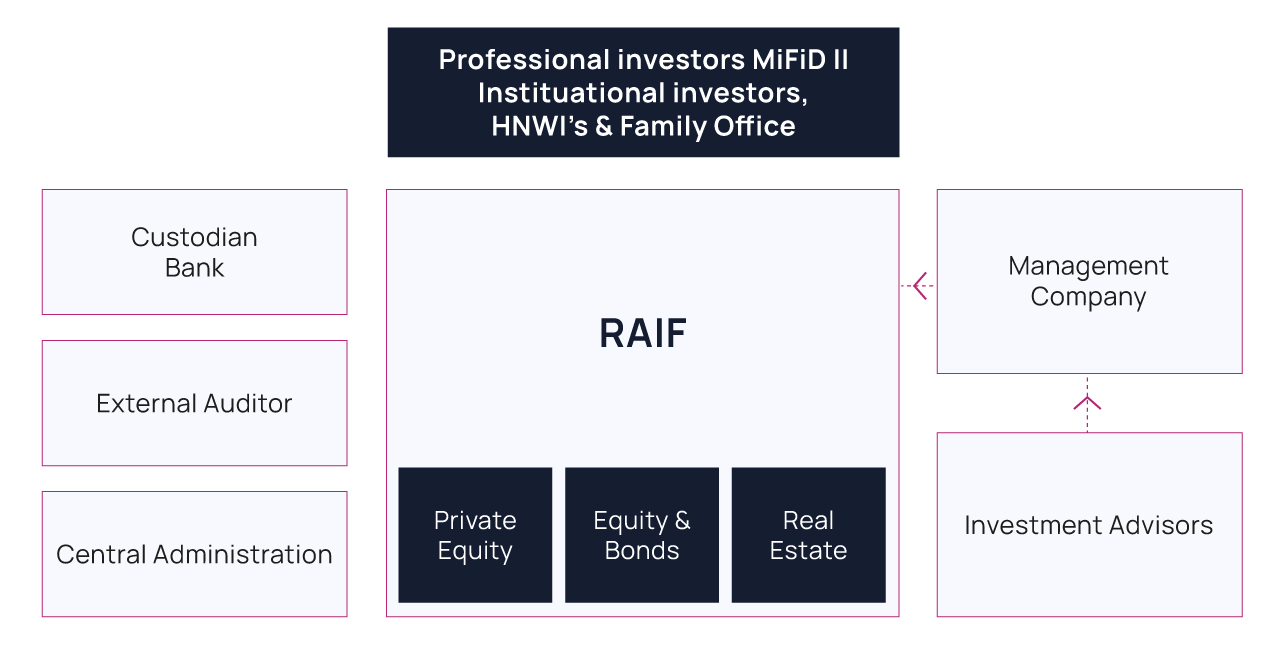

The RAIF is a new unregulated Alternative Investment Fund (under the AIFM directive) proposed to institutional or well-informed investors (who invest a minimum of EUR100.000).

A lot of similiarities exist between the RAIF and Luxembourg Special Investment Funds and Capital risk funds.

The framework of the Reserved Alternative Investment Fund proposes the same flexibility, but is faster for its creation. Reason is that it doesn’t need to be approved for its crestion and its launch by the CSSF, the Luxembourg Financial regulator. The RAIF can indeed be set up within a week, the time to draft the documentation.

The RAIF must be managed by an external regulated Alternative Investment Fund Manager, who can be domiciled in Luxembourg or in any other EU member state, in order to ensure a sufficient level of protection and regulation for the investors.

The RAIF can be subject to the same tax regime that currently applies to the SIF and SICAR funds.

It can be set up as a Special Limited Partnership or a SICAV, and create several compartments for differents projects or strategies.

A Reserved Alternative Investment Fund can invest in any type of assets or strategies as long as the fund doesn't invest mor than 30% of its AUM in the same assets. If the strategy does not allow such risk spreading, the Fund an then be set up as a AIF under the unregulated SLP regime.

More information on RAIF on our dedicated website: www.luxembourg-raif.com

Read also