Creatrust advises Alternative Investment Fund Managers and fund promoters on how to structure their investment portfolios.

Creatrust offers a one-stop-shop solution that turns an initial investment idea into a successful fund.

Investment fund managers turn to Creatrust to make their strategy accessible to relevant audiences. Creatrust establishes and administers unregulated, regulated and private investment vehicles including:

Venture capital and private equity funds:

Venture capitalist and private equity firms setup funds in Luxembourg to invest in deals, co-investment, new ventures, tech companies, blockchain technology, biotech and real estate developments.

Hedge Funds:

A range of investment strategies can be pooled in an alternative investment fund, enabling investors to benefit from the potential returns (long/short, Fund of Funds, Event Driven, Quant, Crypto, Market Neutral, etc.). Creatrust assists managers in structuring the Alternative Investment Fund which is most appropriate to their needs.

Securitisation:

Creatrust advises originators on the transfer of assets to a securitisation vehicle. These vehicles issue securities (equity or notes) which value and yield are linked to the underlying assets (receivables, future cash flows, IP, assets, whole business transactions, synthetic securitisation, etc.)

Crypto Fund:

Crypto fund strategies involve investing in or trading crypto assets, Initial Coin Offerings (ICO), cryptocurrency mining, blockchain related projects, decentralised ledger technology, etc. Crypto strategies can also be structured into alternative investments vehicles.

Co-ownership:

Creatrust creates structures and Special Purpose Vehicles (SPV) which enable investment partnerships. Co-investors pool efforts to support the same investment ideas.

Capital raising:

A great investment idea often requires external finance to succeed. We help investment managers and fund promoters to package their investment propositions effectively to attract multiple rounds of investment, by issuance of security, private placement, listing, ect.

Investment portfolios:

Creatrust develops funds – both private placements and public funds – to give investments managers vehicles that allow investors to access their portfolio management skills, managed account, structure products, and others

S.R.I / Infrastructure:

These projects can be pooled into an alternative investment vehicle which will give exposure to socially responsible investments, green bonds or infrastructure projects.

Popular fund structures

Luxembourg Alternative Investment Funds can be set up as regulated and unregulated vehicles. For regulated vehicles we distinguish between funds targeting the wider public and those aimed at a restricted group of qualified, professional or well-informed investors under private placement. Regulatory oversight is performed by the CSSF, the financial regulation authority in Luxembourg.

Unregulated Alternative Investment Fund / structures include:

Special Limited Partnerships SCSp: setup as a AIF – Alternative Investment Fund

Securitisation entity: Fund or company – to transform assets and future cash flow into securities.

SOPARFI -holding company to structure private equity deals, holding real estate or IP

SPF- Private wealth management company– to invest and protect family office money/assets

RAIF (Reserved Alternative Investment Fund) unregulated AIF managed by a regulated AIFM

Regulated fund structures include:

UCITS– public distribution, retail market

SICAR (Risk Capital Investment Company)– regulated venture capital fund

SIF (Specialised investment Fund)- multi-purpose Vehicle for alternative investments

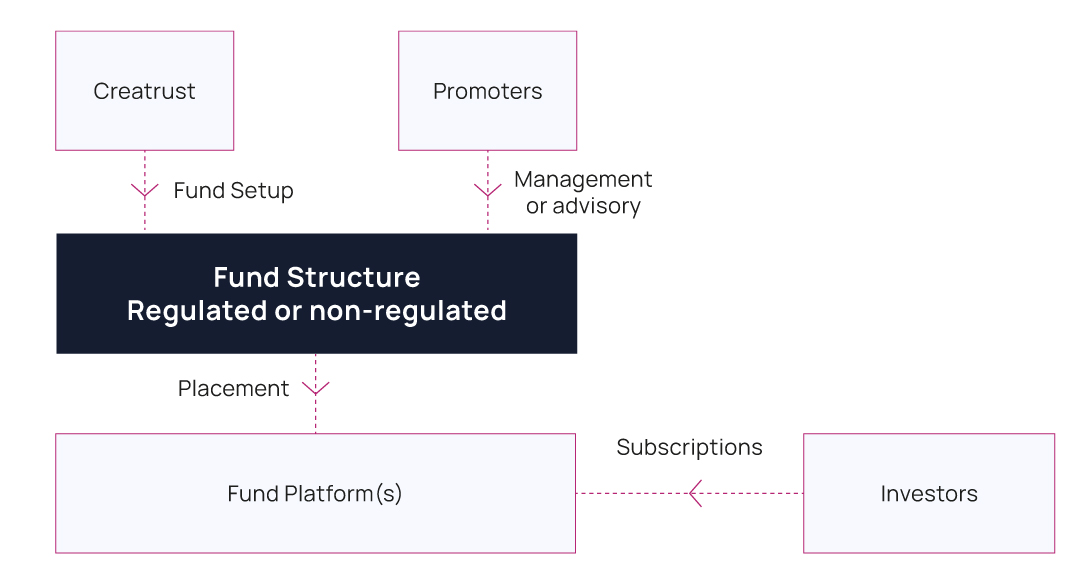

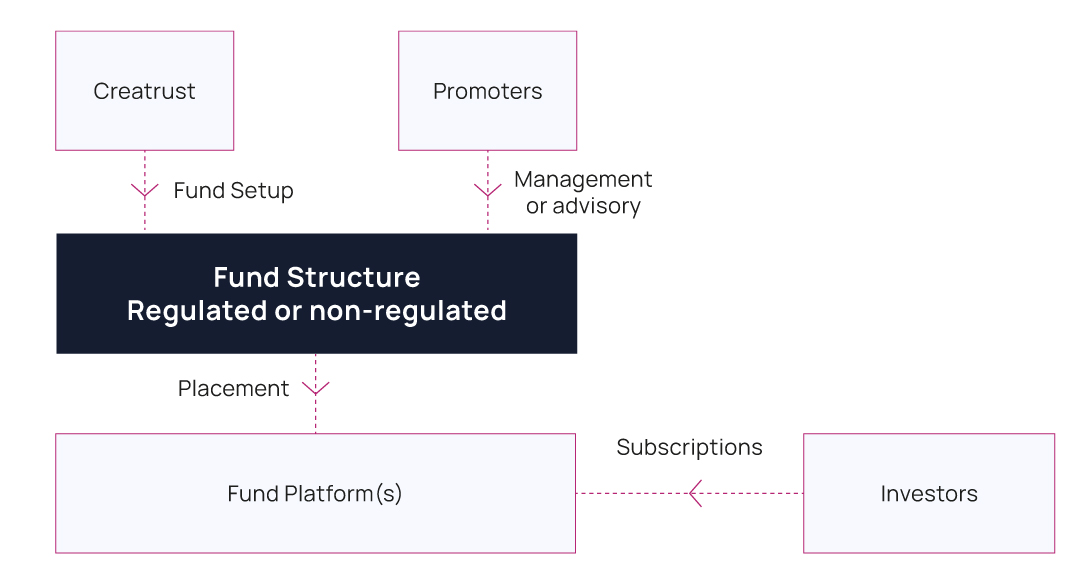

Process to join a Fund Platform:

- Create your own structure - fund

Creatrust will advise on the process to set up the structure in accordance with the project features in order to accommodate the investors needs, depending on the different legal and regulatory requirements.

- Place your fund on a selected Fund platform(s)

Prior to the setup of the fund, promoters will be able to select which platform(s) they wish their fund to be registered on. This facilitates the process of subscription for investors.

Read also: