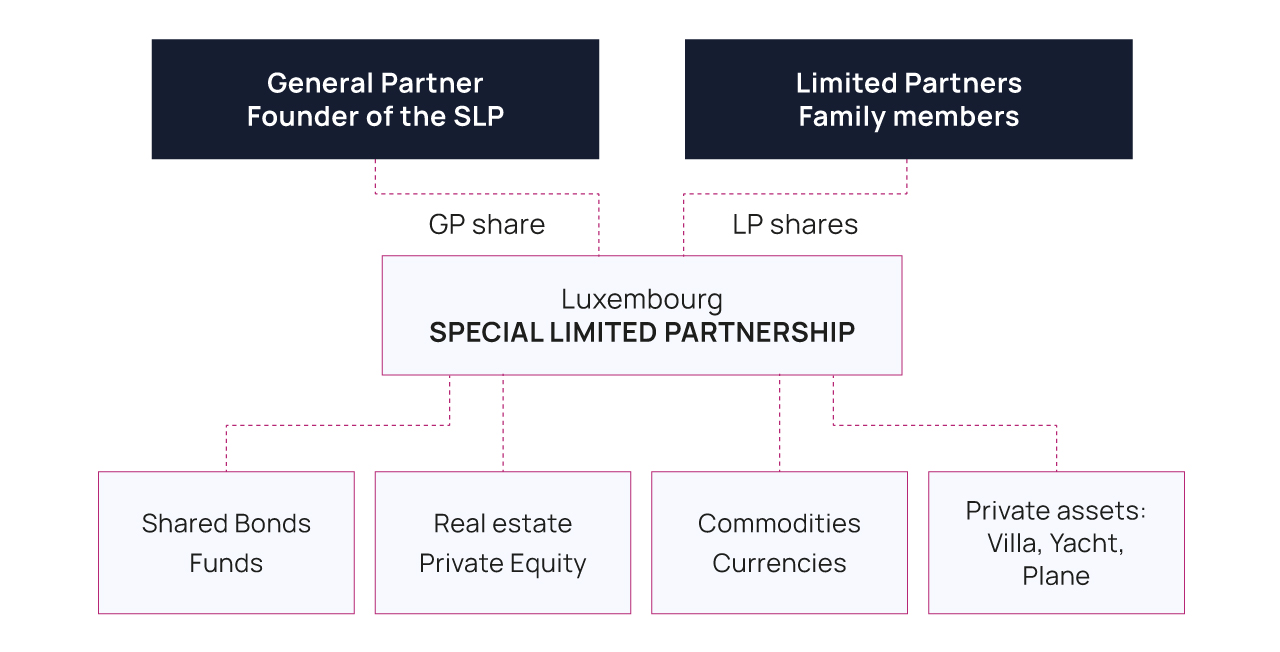

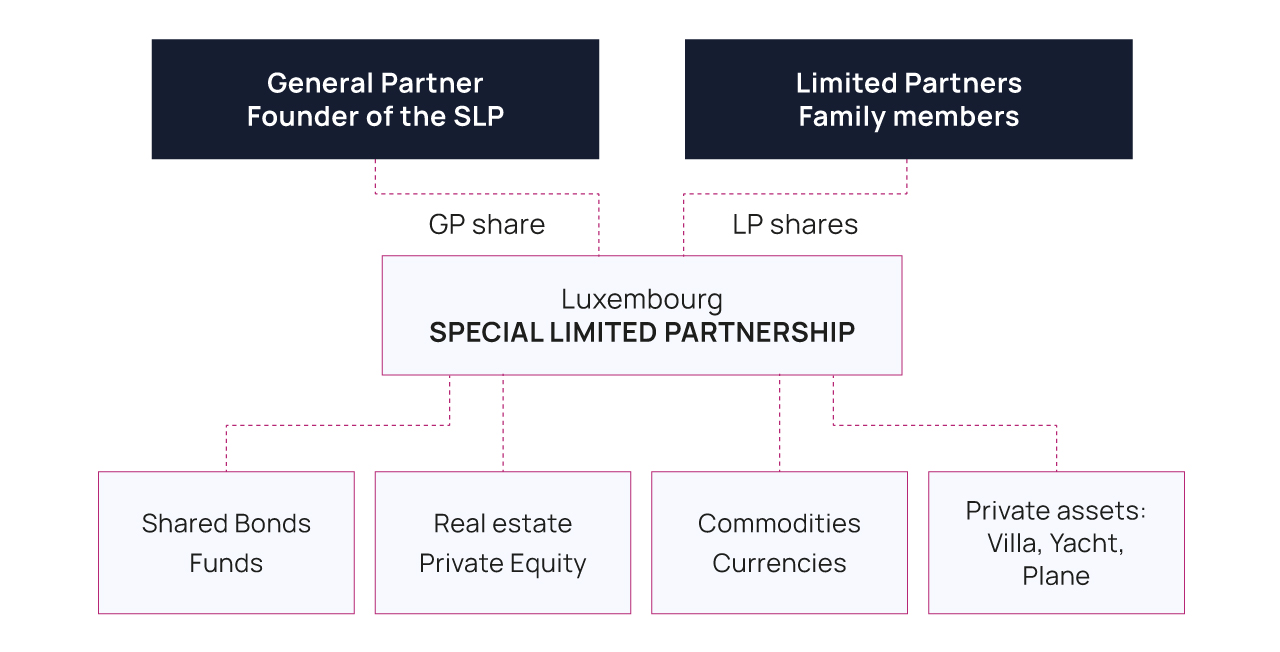

Limited Partnerships can be used as a "Family Trust".

They are established by way of a Partnership Agreement entered into between one General Partner (the founder) and one or more Limited Partners (the family members).

Family Offices may use this flexible vehicle to structure the holding of their wealth by bringing all or part of their assets into such a SLP.

The member of the oldest / first generation (founder) brings his assets in kind to the SLP who will issue different types of shares, one category of shares per generation (the first generation receives share A, the second share B and the third share C).

Each category of shares can be freely organised in the Limited Partnership Agreement (“LPA”).

The LPA can provide with the following :

-

the duration of the SLP (unlimited or a limited period of time) and the way the assets should be distributed in such case

-

the method of reimbursement of partnership interests and the conditions to be met

-

the entitlement of partners to the profits (and losses) of the SLP

-

distributions to the partners, conditions, which may depends on the type of shares

-

voting rights (which are usually given to the first generation)

-

the transfer of partnership interests (restriction or other conditions)

There is no statutory obligation for any of the partners to be based in Luxembourg. There is no limit on the number of partners, category of shares, the conditions - for instance, the ones to be applied to a category of share or even for one particular partner namely (case of the spouse(s) or children of different unions).

Partnership interest

Partnership interests may also represent one particular type of asset, which is a simple way to transfer/allocate an asset to one category of partners or one person.

The partnership may also issue debt securities, hybrid debt, bearing or non bearing a fixed interest or linked to specific asset(s) of the SLP.

There are no statutory restrictions on issues and reimbursements of partnership interests. Limited Partnerships may operate on a variable capital basis allowing capital contributions to be increased or decreased during the life of the Limited Partnership or to be payable in installments as required by the family.

Role of the General Partner

The founder would usually create a limited company which will be appointed as a General Partner.

Management of the Limited Partnership

The management of the limited partnership must be entrusted under the LPA to one or more managers, who may or may not be General Partners. In order to protect third parties dealing with a Limited Partnership, the identity of the manager(s) must be published.

Role of the Limited Partners

The liability of a Limited Partner is restricted to the amount of its contribution to the Limited Partnership. A Limited Partner may not carry out acts of management vis-à-vis third parties.

Reporting

Limited Partnerships under the form of SLPs do not need to publish/prepare annual accounts but are only subject to general commercial accounting rules. The SLP does not need to publish the name of the members of the family. The SLP does not need or appoint an auditor.

Specific provisions for a SLPs as "Family Trust"

-

The LPA can provide for the appointment of an investment committee.

-

The succession can also be planned by providing rules whereby the first category of shares receive all the voting rights and right to distribution.

-

These rights are only granted to the next category of shares when the holders of first category of shares have disappeared.

-

The management can be conducted by a specific committee and its right is limited or subject to a veto right of a category of shares or one particular person.

-

The LPA can provide for the issuance of share giving right to only one assets (tracking shares) or one category of assets or a portion of the capital of the capital of the SLP, excluding the other assets.

Tax transparency for the Special Limited Partnership

From a direct tax standpoint, the primary measure of the AIFMd law is the full tax transparency of the SLP for Corporate Income Tax (“CIT”), Municipal Business Tax (“MBT”) and Net Wealth Tax (“NWT”) purposes. This means that no taxation will be applicable to the profit realised by the SLP (assuming that the GP does not hold more than 5% of the capital of the SLP).

In addition, the distribution of dividends by a SLP is not subject to withholding tax.